The high-end art market is thriving at the moment, with record-breaking sales and purchases. Global art sales surpassed $67 billion in 2018, up 6% from the previous year. A sculpture by Jeff Koons sold for $91.1 million this year, making it the highest price ever paid for a living artist.

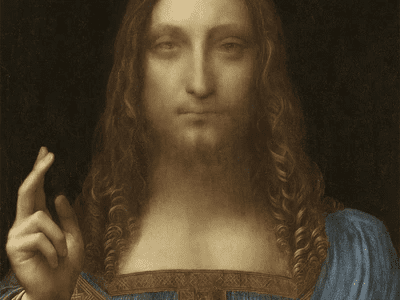

The Saudi royal family purchased a Leonardo da Vinci painting for $450 million in 2017, making it the world’s most expensive art acquisition to date.

So what makes all these artworks worth that enormous amount of wealth? Let’s find out below.

First off, This is a Golden Age of Wealth

It’s no secret that global inequality has been rising for decades, as the wealthy accumulate more and more money at the cost of the world’s poor. The filthy rich; those with a net worth of $30 million or more now go by the less emotional moniker of ‘Ultra High Net-Worth Individuals’ (UHNWI).

In 2017, it was estimated that UHNWIs own about 13% of the world’s wealth, although accounting for only 0.003% of the worldwide population. UNHWIs raised their entire aggregate net worth to $31.5 trillion the next year, a solid 16.3% gain over the previous year. As a result, it’s safe to conclude that now is an excellent moment to be filthy rich. The wealthy’s investment in art has increased dramatically in line with the rise in inequality. According to a survey published in 2018, the wealthy spent 21% more on art than the previous year, marking the first time in over a decade that paintings outspent their second favourite pricey luxury wine.

So, why is art the go-to investment for our ever-increasingly affluent friends?

Art is Now Seen as a Commodity

The concept of art as an investment has been around for a very long time, but it truly took off in the 1960s when shrewd industry insiders decided to publicise the financial possibilities of art in order to profit from the growing postwar economy. As a result, a prominent British auction house partnered with a London newspaper to produce the Times-Sotheby Index; an investment index that tracks the rising values of art sold at auction on a regular basis. The message was clear: art is a hot investment that may outperform traditional investments in terms of returns.

In the decades following, everyone who stood to profit financially from art has pushed it as a lucrative asset class, including art galleries, auction houses, artists, critics, and the broader cultural and financial industries.

The parasitic financial sectors, for example, have been inflating and exploiting art as a source of money using every instrument at their disposal. They created new tools when they ran out of old ones. As a result, new credit instruments, derivatives, securitization funds, and even new blockchain technologies have been brought into the art market in recent years to ensure that ever greater sums of money flow in.

Meanwhile, the art industry’s capitalist institutions have done their lot to milk the situation by pumping up artists, sales, and customers in a never-ending onslaught of frenzied praise, chin-stroking criticism, and cynical PR.

Buying High-End Art is Also Good PR

Finally, for rich countries and individuals whose positions may be jeopardised by negative press, public expenditure on art may be used as a public relations campaign to promote or control one’s reputation.

Take, for example, the competing Gulf kingdoms of Saudi Arabia and Qatar, whose presidents are responsible for four of the ten most expensive painting acquisitions in history. In essence, these affluent rulers have been rebranding themselves as benign benefactors of the arts in recent years, shifting their nations’ image from oppressive regimes to global cultural centres overflowing with the world’s best artistic specimens.

The finest example is the previously stated most expensive artwork ever sold: Salvator Mundi, which was purchased in 2017 by a proxy of Saudi Crown Prince Mohammed Bin Salman. For obvious reasons, this world-record-breaking acquisition made news throughout the world in 2017. However, ongoing events have resulted in an endless stream of news and blog pieces, as content-hungry sources have eagerly covered every detail of the buyer’s mystery, the da Vinci attribution debate, the abandoned display in the new Abu Dhabi Louvre, and so on.

This enthusiastic coverage by a frightened and complicit media has been extremely useful to Bin Salman and Saudi Arabia, as it has helped to divert attention away from unfavourable news like the country’s cruel war in Yemen or the assassination of the writer Jamal Khashoggi. This goes to demonstrate that, while the painting may only be worth a fraction of its near-half-billion-dollar price tag, the public relations reward might be invaluable.

We can see from these variables that art has become a valuable avenue for the world’s wealthiest individuals to grow their money and power in part due to its high potential for returns and capacity to impart status and distinction. All of this is backed and pushed by self-serving financial and cultural sectors seeking to maintain the trend and keep the money coming.

Information Citations

En.wikipedia.org, https://en.wikipedia.org/.

Recommend0 recommendationsPublished in Uncategorized

Responses